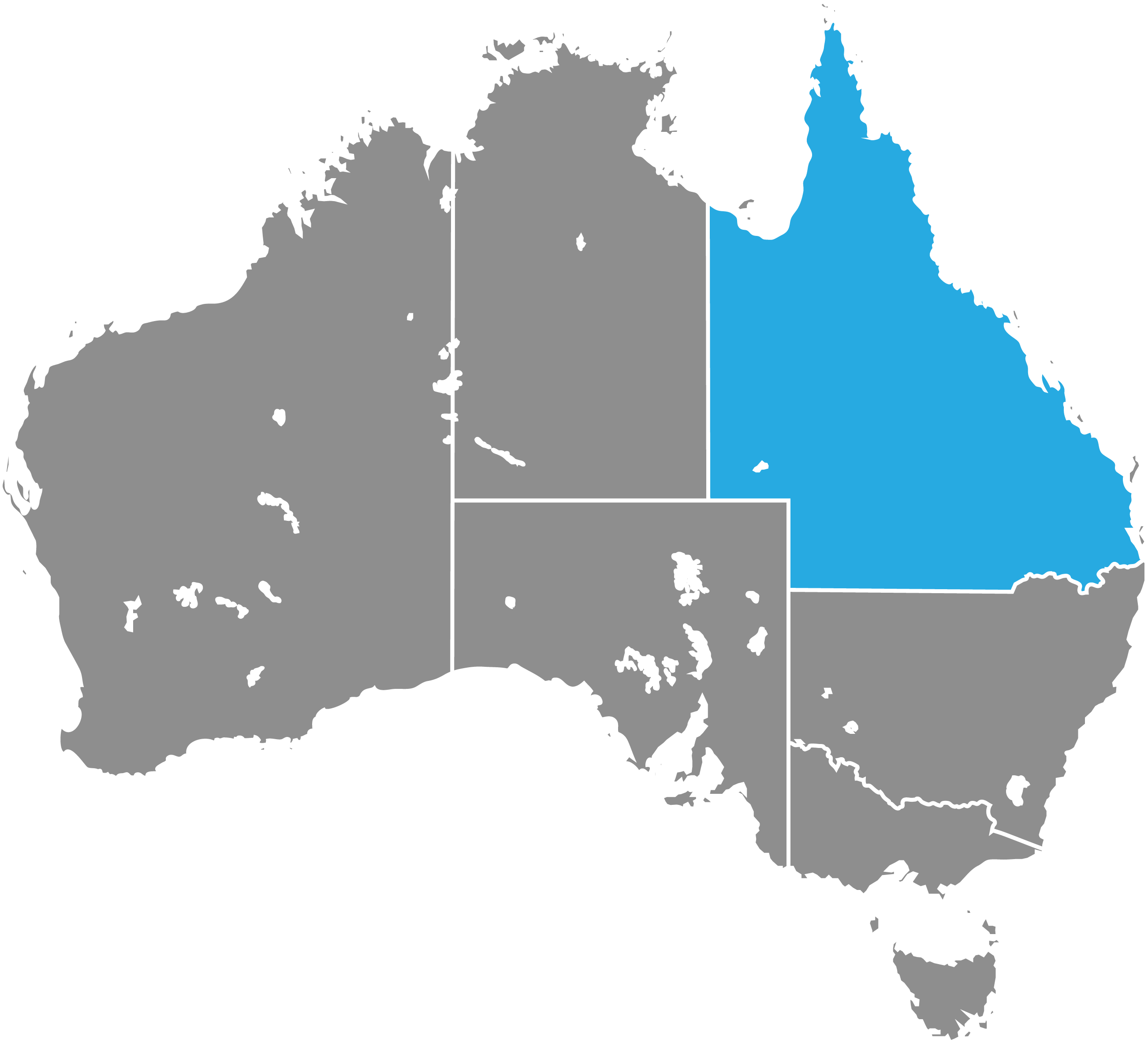

Landlord Insurance In QLD

Important Coverage Tips

Most Common Claims

When renting out a property in Queensland, it's crucial for landlords to carry insurance in case of any unforeseen damage or loss. Landlords should be prepared for claims arising from a range of typical causes, including as fires, storms, floods, tenant misconduct, and malicious acts.

Storm damage is a common reason for insurance claims in Queensland. Roofs, outside walls, and even home furnishings and air conditioning units can all sustain damage from storms. Flooding is a serious problem in Queensland, and it has a significant impact on rental homes in low lying suburbs.

Landlords in Queensland can better protect their investments by learning about and preparing for the hazards associated with owning rental property.

Brisbane Area

In Brisbane, Australia, flood damage is a common reason for insurance claims from landlords. Suburbs in low-lying areas close to the Brisbane River are particularly at risk for landlord insurance claims. The suburbs of Oxley, West End, South Brisbane, St. Lucia, and Rocklea are among those most at risk from flooding.

Far North Queensland

Cyclones and other forms of extreme weather in the Far North Queensland region of Australia can inflict significant damage to buildings and substantial losses to property owners. Cairns, Port Douglas, and Townsville, along with other nearby suburbs, are more at risk for cyclone-related insurance claims because of their greater exposure to the elements. High winds, flooding, storm surges, fallen trees, and structural damage to roofs, external walls, and windows are common causes of insurance claims for landlords. Landlords should check their insurance policies to be sure they will pay for the full cost of repairing the property and its contents, as well as loss of rent cover if the property is uninhabitable.

Rural Queensland

Queensland's outback experiences a hot, dry climate that makes bushfires extremely dangerous. Bushfires are an all too typical occurrence in the rural areas of Queensland. Even though smoke and heat damage accounts for the bulk of claims in these regions, claims for complete loss of property and contents are are common occurrence. It's because of the high temperatures and the rapid spread of bushfires, which completely destroys homes and forces their owners to start over.

Pricing

Landlord insurance cover starts at $355 with Australian Landlord Insurance in Queensland. This is includes cover for all the most common claims such as Storm, Flood, Damage, Fire & Cyclone Damage as well as rental default & rental loss.

Building insurance & combined cover pricing can vary greatly, please get in touch with one of our team members for a personalised quote.